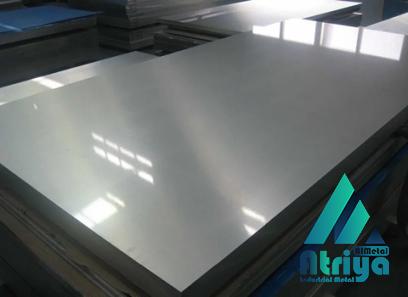

A Key Indicator of the Global Steel Market In the ever-evolving business landscape, it is crucial for companies to stay informed about market trends and indicators that can impact their operations. One such indicator in the steel industry is the LME Steel HRC. The London Metal Exchange (LME) is the world’s oldest and largest market for trading base metals, and the LME Steel HRC is an important benchmark for pricing and trading hot-rolled coil steel. Hot-rolled coil (HRC) is a type of steel that is widely used in various industries such as automotive, construction, and manufacturing. It is produced by heating a slab of steel above its recrystallization temperature and then rolling it into a thin strip. The LME Steel HRC is a standardized contract that allows traders and manufacturers to hedge against price fluctuations and manage their risk exposure in the steel market.

.

The LME Steel HRC contract provides a transparent and efficient platform for buyers and sellers to trade HRC steel. The contract size is 25 metric tons, and it is settled in cash, rather than physical delivery. This enables market participants to speculate on steel prices or manage their inventory without the need for physical storage or transportation. The contract is denominated in US dollars per metric ton and is quoted in cents per pound. The LME Steel HRC price is influenced by a multitude of factors, including supply and demand dynamics, geopolitical events, and macroeconomic factors. Steel is a globally traded commodity, and its prices can fluctuate based on regional and international market conditions. For instance, changes in raw material costs, such as iron ore and coking coal, can impact steel prices.

The LME Steel HRC contract provides a transparent and efficient platform for buyers and sellers to trade HRC steel. The contract size is 25 metric tons, and it is settled in cash, rather than physical delivery. This enables market participants to speculate on steel prices or manage their inventory without the need for physical storage or transportation. The contract is denominated in US dollars per metric ton and is quoted in cents per pound. The LME Steel HRC price is influenced by a multitude of factors, including supply and demand dynamics, geopolitical events, and macroeconomic factors. Steel is a globally traded commodity, and its prices can fluctuate based on regional and international market conditions. For instance, changes in raw material costs, such as iron ore and coking coal, can impact steel prices.

..

Similarly, economic indicators like GDP growth, industrial production, and construction activity can influence the demand for steel and subsequently its price. The LME Steel HRC is closely followed by steel producers, traders, investors, and analysts as it provides insights into the overall health of the steel industry. Changes in the LME Steel HRC price can signal shifts in supply and demand dynamics, market sentiment, and price trends. Additionally, it serves as a reference point for pricing steel contracts between buyers and sellers outside of the exchange. Analyzing the LME Steel HRC can help businesses make informed decisions regarding their steel procurement and pricing strategies.

Similarly, economic indicators like GDP growth, industrial production, and construction activity can influence the demand for steel and subsequently its price. The LME Steel HRC is closely followed by steel producers, traders, investors, and analysts as it provides insights into the overall health of the steel industry. Changes in the LME Steel HRC price can signal shifts in supply and demand dynamics, market sentiment, and price trends. Additionally, it serves as a reference point for pricing steel contracts between buyers and sellers outside of the exchange. Analyzing the LME Steel HRC can help businesses make informed decisions regarding their steel procurement and pricing strategies.

…

For steel manufacturers, fluctuations in the LME Steel HRC can impact production costs and profit margins. They can utilize this information to negotiate pricing with their customers or adjust their production levels to optimize profitability. Similarly, steel buyers can monitor the LME Steel HRC to anticipate price movements and plan their procurement activities accordingly. In conclusion, the LME Steel HRC is a key indicator of the global steel market and is closely monitored by industry participants. Its price reflects supply and demand dynamics, as well as macroeconomic factors that influence steel prices. By keeping an eye on the LME Steel HRC, businesses can make informed decisions and manage their exposure to price fluctuations in the steel market.

For steel manufacturers, fluctuations in the LME Steel HRC can impact production costs and profit margins. They can utilize this information to negotiate pricing with their customers or adjust their production levels to optimize profitability. Similarly, steel buyers can monitor the LME Steel HRC to anticipate price movements and plan their procurement activities accordingly. In conclusion, the LME Steel HRC is a key indicator of the global steel market and is closely monitored by industry participants. Its price reflects supply and demand dynamics, as well as macroeconomic factors that influence steel prices. By keeping an eye on the LME Steel HRC, businesses can make informed decisions and manage their exposure to price fluctuations in the steel market.

Your comment submitted.